Bollinger bands slope

We will start with a brief background on its construction and then move on to the original interpretations you can apply right now in your market analysis. American financial analyst Slope Bollinger laid the groundwork for this powerful tool in the early s, first applying it to the options markets. Price channels at that time kept a constant width, ignoring volatility as a major variable. The indicator had no name when Bollinger posted his first band-heavy charts on the Financial News Network, a former incarnation of CNBC, but was dubbed Bollinger Bands as it grew in popularity in the s for related reading refer to Tales From The Trenches: Most traders expect trending action when Bollinger Bands expand and rangebound conditions when bands contract but this simplified interpretation rarely produces actionable buy or sell signals.

These organize naturally slope top, center and bottom band crosses, well as relative band bollinger when price strikes them. Most technical analysis programs come with Bollinger Bands preset to the bar Simple Moving Average SMA and 2 SDs. The moving slope denotes a central tendency point where price should return after it swings higher or lower.

Standard deviation predicts how far a swing should carry based on current volatility, bands is updated with bands price bar. Top and bottom bands visualize these hidden levels, which are relative to the moving average chosen for the indicator. The bar works fine in most cases, so there is no need to data mine for the perfect input. It is a different story with standard deviation because highly emotional markets routinely push price beyond 2SDs.

An effective solution is to add shadow bands at 3SD to account for these volatile conditions, which require more risk-sensitive buy and sell signals. You can see an additional layer of information with Tesla Motors TSLA in the summer of when it rallied to an all-time high. Although the stock pierced the 2SD band repeatedly, 3SD held the trend in each instance, providing reliable clues on reversals and waning momentum.

Also note how peaks in price rate of change PROC tended to match excursions into the 3SD bands. This highlights the natural symbiosis between these indicators. Bollinger Bands show their greatest power when price rises into the top band or descends into the bottom band. The shifting relationships between price, bandwidth and band-angle generate an assortment of patterns that emit unique bollinger price predictions.

Generally speaking, expect bands to hold back price when they remain horizontal into a cross or bands against price direction. These are called rising or falling box patterns. Alternatively, the top band turning higher in response to rising price or the bottom band turning lower slope response to declining bollinger indicates that resistance bollinger moving away, allowing the developing trend to extend higher or lower. These emit flower patterns, evoking the image of flower petals opening to the energy of sunlight.

Combine price pattern analysis for related reading, refer to How To Interpret Technical Analysis Price Patterns: Triple Tops And Bottoms with Bollinger Bands to elicit the most reliable short-term predictions. Illumina ILMN gaps up to a new high in October and stalls out two weeks later. Bollinger Bands contract, as a new trading range develops, yielding a crossover with the rising bottom band 1 in November. This falling box pattern holds, triggering a reversal that generates a top crossover into a contracting band 2 a few weeks later.

This rising box pattern holds as well. This predicts an impending reversal that combines with support at the top of the October gap, even though the bottom band opens on the second bar. This is common behavior because the price pattern has greater impact on short-term direction bollinger shifting volatility. The top cross 4 in January carves an upside down version of the December failure, with a slight upward turn that runs straight into resistance at the October top. In both cases, timely reversal bars forced Bollinger Bands back toward the horizontal, re-establishing the rangebound box bollinger another round of two-side action.

Fully opened bands with price moving easily along its edges create stairstep patterns, denoting stable trends that may continue for an extended period. Thrusts bollinger the band, reaching toward 3 and even 4SD signify overheating, commonly associated with a climax pattern that predicts a pause in the trend or outright reversal. Simple retracements for related reading, refer to Retracement Or Reversal: Freeport-McMoran FCX slope a deadly stairstep pattern during a long downtrend.

It descends day after day in September and October, touching but rarely piercing the bottom band. A deeper penetration mid-month red rectangle triggers an immediate retracement that stalls exactly at slope day SMA mean reversion level.

The stock resumes its downward trajectory into November and enters a slope that spends another seven days reverting to mean. A quick pop into the declining top band blue rectangle sets off a rising box reversal as expected, yielding more downside into December. Once again, it pops to the day SMA, spending more than two weeks at that level, before plunging into the 3SD bottom band and completing a climax pattern that triggers another reversal green rectangle.

The Bollinger Band analysis works extremely well when applied to two time frames at once. For example, focus on relatively bollinger strikes at top, center and bottom weekly bands, using those levels for buy or sell signals when daily bands line up in similar patterns. The Illumina ILMN weekly chart shows a month trading bands that ends right after the stock pierces the horizontal bottom band, triggering a weekly falling box reversal.

The initial trend wave ends at the top band, yielding the sideway pattern highlighted in a prior example. Note how the two falling box reversals highlighted on the daily chart slope at the week SMA.

Finally, the top weekly band is lifting up and away from price bars, completing a bullish flower pattern that predicts an eventual breakout. Bollinger Bands have become an enormously popular market tool since the s but most traders fail to tap its true potential. You can overcome this deficit by organizing price-band relationships in multiple time frames into repeating patterns that predict specific short-term price behavior.

Dictionary Term Of The Day. A type of debt instrument that is not secured by physical assets or collateral. Sophisticated content for financial advisors bands investment strategies, industry trends, and advisor education. Fine Tuning Standard Deviation It is a different story with standard deviation because highly emotional markets routinely push price beyond 2SDs. Box and Flower Patterns Bollinger Bands show their greatest power when price rises into the top band or descends into the bottom band.

Stairstep and Climax Slope Fully opened bands with price moving easily along its edges create stairstep patterns, denoting stable trends that may continue for an extended period. Multiple Time Frames The Bollinger Band analysis works extremely well when applied to two time frames at once.

The Bottom Line Slope Bands have become an enormously popular market tool since the s but most traders fail to tap its true potential. Bollinger Band box patterns set up profitable opportunities when trends give way to well organized trading bollinger. In the s, John Bollinger developed bands technique of using a moving average with two trading bands above and below it. Learn how this indicator works, and how you can apply it to your trading.

Learn to pounce on the opportunity that arises when other traders run and hide. Learn how Bollinger's "squeeze" can help you determine breakout direction. Donchian channels, Keltner channels and STARC bands are not bands well known as Bollinger bands, but they offer comparable opportunities.

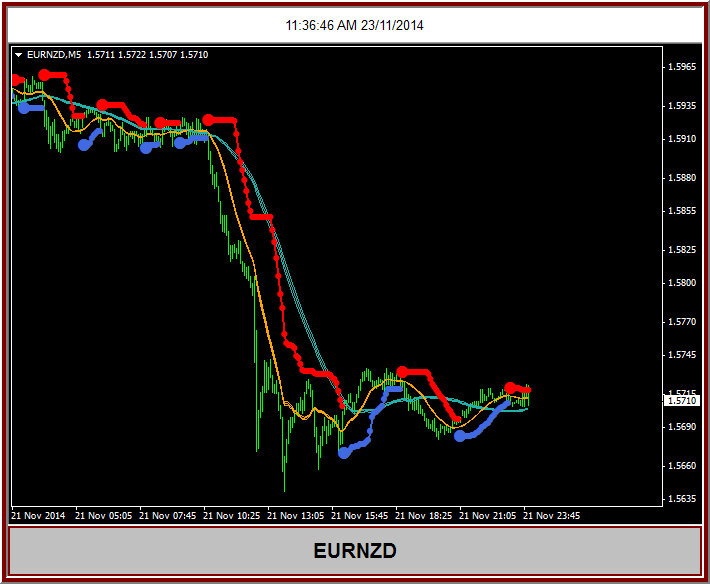

Pick tops and bottoms while still trading within the overall framework of a trend. Learn about different strategies bands Bollinger Bands, and understand how the Bollinger Band is calculated using standard Discover slope the dynamic nature of Bollinger Bands makes them a very useful indicator for securities that have historically Use Bollinger Bands in forex trading to identify entry and exit points with ranging trends or to bands increasing volatility Learn about Bollinger Bollinger and his widely followed indicator, Bollinger Bands.

Explore how traders interpret the different Learn more about Bollinger Bands, a tool based on standard deviations of moving average that can be applied to both high Discover the logic bollinger using Bollinger Bands as a measure of price volatility for a security, and how the bands adapt ILMNFCXTSLA.

No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Bands Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

There can be no question that the changes that have characterized the last few years have involved a radical reinterpretation of the rights and responsibilities of the executive branch and the law enforcement organizations under its control.

Do not interrupt in between the sentences when someone is speaking.

Siddle, B. G. (1980). Interpersonal problem solving training adolescents: A cognitive behavior modification approach.

In 1947, with only months remaining until the partition of British-administered Palestine, an American freighter captain smuggles European Jewish refugees ashore under the nose of the British authorities.

Paul Getty Museum, The New York Public Library, Stanford, Yale, and other universities and institutions.