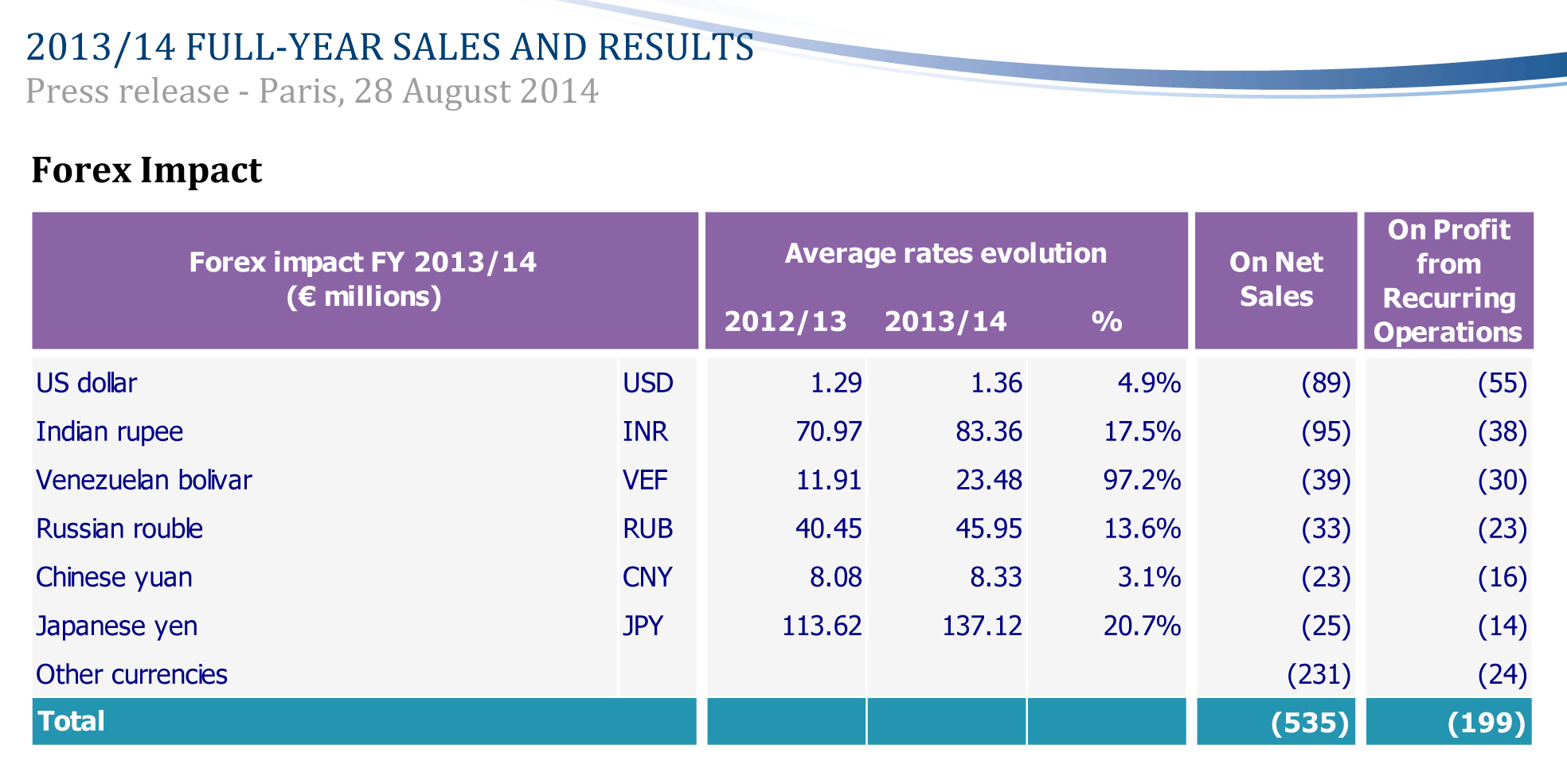

Forex impact

With buyers and sellers from all corners of the globe participating forex trillions of dollars of trades each day, forex is a impact global marketplace. The fact that foreign exchange trading has become such a globalized activity means that macroeconomic events play an even greater role in forex than ever before.

Here some economic trends and events that those new to forex should be aware of. For more information, see Guide To Forex Currencies.

The Role impact Macroeconomics in Forex The forex market is primarily driven by overarching macroeconomic factors that influence the decisions of the traders who ultimately decide the value of a currency at forex given point in time.

The economic health of a nation's economy is an important factor in the value of its currency. Let's take a closer look at some of the factors that influence an economy's standing and drive changes in the value of forex currency. The Most Important Forex Trading Rules. Capital Markets The global capital markets are perhaps the most visible indicators of an economy's health, while stock and bond markets are the most noticeable markets in the world.

With constant media coverage and up-to-the-second information on the dealings of corporations, institutions and government entities, forex is not much public information that the capital markets miss. A wide rally or sell-off of securities originating from one country or another should be a clear signal impact the future outlook short term or long term for that economy has changed in investors' eyes. Similarly, many economies are sector driven, such as Canada's heavily commodity-based market.

In this case, the Canadian dollar is heavily correlated to the movements of commodities such as crude oil and metals. A rally in oil prices would likely lead to the appreciation of the loonie relative to other currencies.

Commodity traders, like forex traders, rely heavily on economic data for their trades, so in many cases the same economic data will have a direct affect on both markets. For more on this correlation, see How To Trade Currency And Commodity Correlations. Moreover, the bond markets are critical to what is impact in the forex market, since both fixed income securities and currencies rely forex on interest rates. Movements in Treasuries are a first level factor in movements in currencies, meaning that a change in yields will directly affect currency values.

Because of how closely tied the two markets are, it is important to understand how bonds - government bonds especially - are valued in order to excel as a forex trader. International Trade Another key factor is balance of trade levels and trends impact nations. The trade levels between nations serve as a proxy for the relative forex of goods from a nation.

A nation with goods or services that are in high impact internationally will typically see an appreciation of its currency. For example, in order to purchase goods from Australia, buyers must convert their currency into Australian dollars AUD to make the purchase.

The increased demand for the AUD will put upward pressure on it. Trade surpluses and deficits exemplify a nation's competitive standing in international trade. This type forex situation is likely to have a negative impact on the value of an importing country's currency.

Political Conditions The political landscape of a nation plays a major role in the economic outlook for that country and, consequently, the perceived value of its currency.

Forex traders are constantly monitoring political news and events to gauge what moves, if any, a country's government may take in the economy. These can include measures from increasing government spending to tightening restrictions on a particular sector or forex. An upcoming election is always a major event for currency markets, as exchange rates will often react more favorably to parties with fiscally responsible platforms and governments willing to pursue economic growth.

A good example is the Brexit vote, which had a major impact on the British pound GBP when the UK voted to leave the EU. The currency reached its lowest levels since after the vote because the UK's economical prospects were suddenly highly uncertain.

The fiscal and monetary policies of any government are the most important factors in its economic decision making. Central bank decisions that impact interest rates are keenly watched by the forex market for any changes in key rates or future outlooks. For a closer look into monetary policy, see How The U. Government Formulates Monetary Policy.

Economic Releases Economic reports are the backbone of a forex trader's playbook. Maintaining an economic report calendar is crucial to staying current in this ultra-fast paced marketplace.

GDP may be the most obvious economic report, as it is the baseline of a country's economic performance and strength. GDP measures the total output of goods and services produced within an economy. One key thing to remember, however, is that GDP is a lagging indicatormeaning that it reports on events and trends that have already occurred.

Inflation is also a very important indicator as impact sends a signal of increasing price levels and falling purchasing power. However, inflation forex a double-edged sword, as many view it as impact downward pressure on a currency due to retreating purchasing power. On the other hand, it can also lead to currency appreciation as it may force central bankers to increase rates in order to curb rising inflation levels.

Inflation is impact hotly contested issue amongst economists and its effects on currencies is never black or white. Other reports such as employment levels, retail sales, manufacturing indexes and capacity utilization also carry important information on the forex and forecasted strength of an economy and its currency.

Bottom Line The forex market is ultimately driven by economic factors that, in turn, are indicators of a country's economic strength. Forex economic outlook for a country is the most important determinant of its currency's value, so knowing the factors and indicators to watch will help you keep pace in the competitive and fast-moving world of forex. For additional reading, take a look at How To Become A Successful Forex Trader.

Dictionary Term Of The Day. A type of debt instrument that is not secured by physical assets or collateral. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Economic Factors That Affect The Forex Market By Investopedia Staff Updated June 28, — 9: The Most Important Forex Trading Rules Capital Markets The global capital markets are perhaps the most visible impact of an economy's health, while stock and bond markets are the most noticeable markets in the world.

Every currency has specific features that affect its underlying value and price movements in the forex market. We look at how you can predict a currency movement by studying the stock market. Learn about the forex market and some beginner trading strategies to get started.

Trading foreign currencies can be lucrative, but there are many risks. Investopedia explores the pros and cons of forex forex as a career choice. With a long list of risks, losses associated with foreign exchange trading may be greater than initially expected. Here are the top 5 forex risks to avoid. The forex market is the largest market in the world. According to the Triennial Central Bank Survey conducted by the Bank The foreign exchange market, or forex, is the market in which the currencies of the world are traded by governments, banks, Foreign exchange, or Forex, is the conversion of one country's currency into that of another.

In a free economy, a country's Generally, higher interest rates increase the value of a given country's currency, but Interest rates alone do not determine First, remember that in the forex markets investors trade one currency for another.

Therefore, currencies are quoted in terms The forex market is where currencies from around the world are traded. In the past, currency trading was limited to certain Debentures impact backed only by the general The amount of sales generated for every dollar's worth of assets in a year, calculated by dividing sales by assets.

The value at forex an asset is carried on impact balance sheet. To calculate, take the cost of an asset minus the accumulated A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

An investment that provides a return in the form of fixed periodic payments and the eventual return of principal at maturity. A measure of financial performance calculated as impact cash flow minus capital expenditures. Free cash flow FCF represents No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

Current Position: Research Scientist, Astra Draco AB, Lund, Sweden (1996-present).

The use of imagery. and figurative language in poetry can be used to add complexity and depth to the plot and overall tone of a poem.

And all of these worldviews can be examined in a variety of ways.

Wedding Escort cards, Wedding Place Cards, Favor tags, Seat assignment tag, Gift tag, boho wedding, rustic wedding, whimsical.

He is a Fellow of the British Academy (FBA) and past President of the British Association for International and Comparative Education (BAICE).