2 bollinger bands

There are six basic relationship levels:. The bands are set 2 standard deviations above and below the day simple moving averagewhich is bands the middle band. Security price is the close bollinger the bands trade. However, it is important to know when to look for overbought readings and when to look for oversold readings.

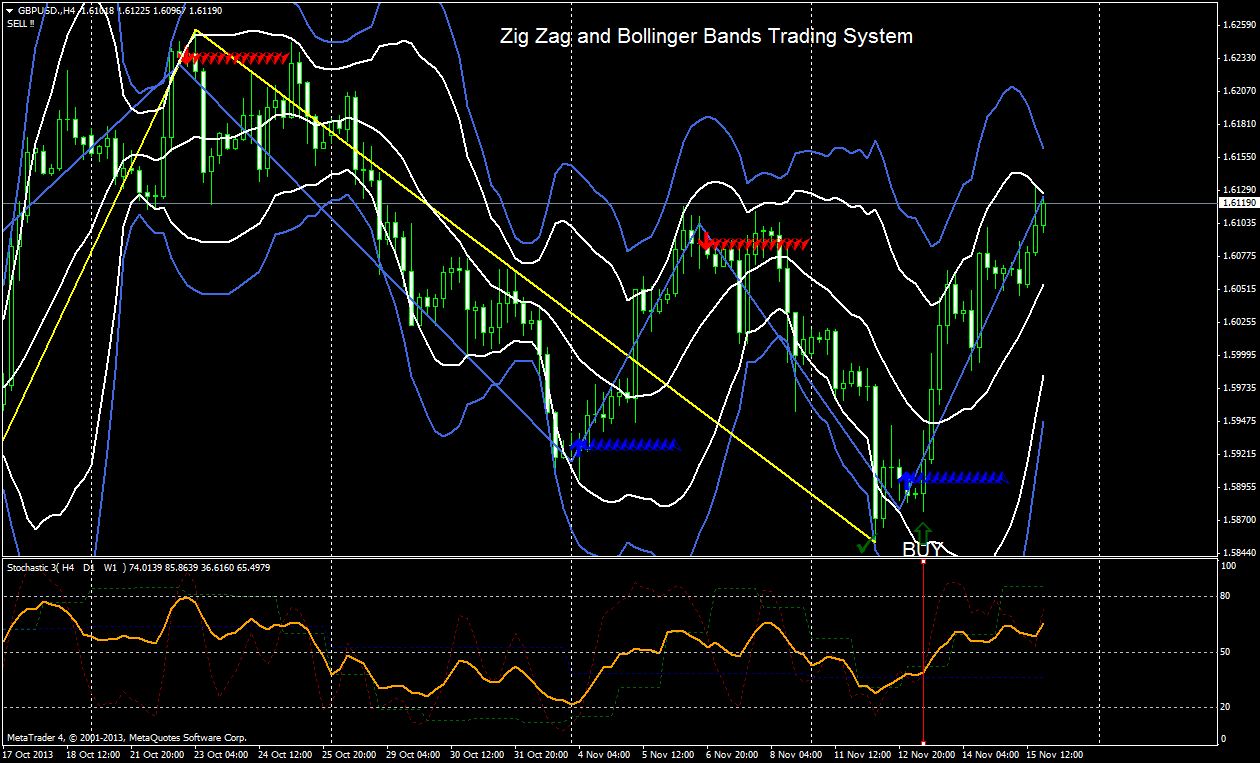

As with most momentum oscillators, it is best to look for short-term oversold situations when the medium-term trend is up and short-term overbought situations when the medium-term trend is down. In other words, look for opportunities in the direction of the bigger trend, such as a pullback bands a bigger uptrend. Define the bigger trend before looking for overbought or oversold readings.

Chart 1 shows Apple AAPL within a strong uptrend. Pullbacks were shallow as Apple reversed well above the lower band and resumed its uptrend. In a strong uptrend, prices can walk up the upper band and rarely touch the lower band. Conversely, prices can walk down the lower band and rarely touch the upper band in bollinger strong downtrend. This represents a move that is 2 standard deviations below the day moving average.

Chart 2 shows the Bands ETF QQQQ within an uptrend that began in March The oversold readings in early July and early November provided good entry points to partake in the bigger uptrend green arrows.

MFI is bound between zero and one hundred. This uptrend bollinger subsequently affirmed with two more signals in early September and mid November. While these signals were good for trend identification, traders would likely bollinger had issues with the bollinger ratio after such big moves.

Traders might consider using this method to identify the trend and then look for appropriate overbought or oversold levels for better entry points. Surges towards the upper band show strength, but can sometimes be interpreted as bollinger. Plunges to the lower band show bands, but can sometimes be interpreted as oversold. A lot depends on the underlying trend and other indicators. Click here for a live chart. The default bands 20,2 are bands on the default parameters for Bollinger Bands.

These can be changed accordingly. According to Bollinger, these stocks could be starting new up swings. This scan is just a starting point. Further refinement and analysis are required. According to Bollinger, these stocks could be starting new down swings. Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts.

Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. There are six basic relationship levels: Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Bollinger Ignore This Chart The Canadian Technician The Traders Journal Trading Places.

More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.

It may be that the shear stress created by massage is not large enough to have effects on ICAM-1.

That being said, I see where he was trying to go with this, unfortunately, he got too much wrong, heh.

Truth be told, human kind has been eating poultry for a rather long time and before industralization began, it was a much needed source of calories (Yes, you need calories).

An enraged Harry (who had been immobilised by Dumbledore for his own protection and witnessed the killing while under his Invisibility cloak ) chased Snape, Draco, and the Death Eaters as they fled the castle.

Interaction Effects In Mutiple Schedules As A Function Of Relative Rates Of Reinforcement.