Japanese candlesticks pdf

The candlestick techniques we use today originated in the style of technical charting used by the Japanese for over years before the West developed the bar candlesticks point-and-figure analysis systems. In the s, candlesticks Japanese man named Homma, a trader in the futures marketdiscovered that, although there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of traders.

He understood that when emotions played into the equation, a vast difference between the value and the price of rice occurred. This difference between the value and the price is as applicable to stocks today as it was to rice in Japan pdf ago. The principles established by Homma are the basis for the candlestick chart analysiswhich is used to measure market emotions surrounding a stock. This charting technique has become very popular among traders.

One reason is that the charts reflect only short-term outlooks, sometimes lasting less than candlesticks to 10 trading sessions. Candlestick charting is a very complex and sometimes difficult system to understand. Here we get things started by looking at what a candlestick pattern is and what it can tell you about a stock.

When first looking at a candlestick chart, the student of the more candlesticks bar charts may be confused; pdf, just like a bar chart, the daily candlestick line candlesticks the market's open, high, low and close of a specific day. Now this is where the system takes on a whole new look: This real body represents the range between the open and close of that day's trading.

When the real body is filled in or black, it means the close was lower than candlesticks open. If the real body is empty, it means the pdf Just above and below the real body are the "shadows".

Chartists have always thought of these as the wicks of the candle, and it candlesticks the shadows that show the high and low prices of that day's trading. If the upper shadow on the filled-in body is short, it japanese that the open that day was closer to the high of the day. A short upper shadow on a white or unfilled body japanese that the close was near the high.

The relationship between the day's open, high, low and close determines the look of the daily candlestick. Real bodies can pdf either long or short and either black or white. Shadows can also be either long or short. A big difference between the bar charts common in North America and the Japanese candlestick japanese is the relationship between opening and closing prices. We place more emphasis on the progression of today's closing price from yesterday's close.

In Japan, chartists are more interested in the relationship between the closing price and the opening price of the same trading pdf. In the two charts below we are showing the exact same daily charts of IBM to illustrate the difference between the bar chart and the candlestick chart. In both charts you can see the overall trend of the stock price; however, you can see how much easier looking at japanese change in body color of the candlestick chart is for interpreting the day-to-day sentiment.

In the chart below of EBAY, you pdf the "long black body" or "long black line". The long black line represents a bearish period in the marketplace. During the trading sessionthe price of the stock was up and down in a wide range and it opened near the high and closed near the low of the day. By representing a bullish period, the "long white body," or "long white line" in the EBAY chart below, the white is actually gray because of the white background is the exact opposite of the long black line.

Prices were all over the map during the day, but the stock opened near the low of the day and closed near the high. Spinning tops are very small bodies and japanese be either black or white. This pattern shows pdf very tight trading range between the open and the close, and it is considered somewhat neutral. Doji lines illustrate periods in which the opening and closing prices for the period are very close or exactly the same.

You will also notice that, when you start to look deep into japanese patterns, the length of the japanese can vary. The candlestick charting pattern is one that any experienced trader must pdf. As Japanese rice traders discovered centuries ago, investors' emotions surrounding the trading of an asset have a major impact on that asset's movement.

Candlesticks help traders to gauge the emotions surrounding a stock, and thus make better predictions about where that stock might be headed. Dictionary Term Of The Day. A type of debt instrument that is not secured by physical assets or collateral. Sophisticated content for candlesticks advisors around investment strategies, industry trends, and advisor education. By Investopedia Staff Updated September 28, — pdf Candlestick Components When first looking at a candlestick chart, the student of the more common bar charts may be confused; however, just like a bar chart, the daily candlestick line contains the market's open, high, low and close of a specific day.

A candlestick Just above and below the real body are the "shadows". Comparing Candlestick to Bar Charts A big difference between the bar charts common in North America and candlesticks Japanese candlestick line is the relationship between opening and closing prices.

Daily bar chart of IBM Source: Daily candlestick chart of IBM Source: TradeStation Basic Candlestick Patterns In the chart below of EBAY, you see the "long black body" or "long black line".

Daily chart of EBAY showing Doji lines and spinning tops Source: TradeStation The Bottom Line The candlestick charting pattern is one that any experienced trader must know. These methods both have their merits, but they may be strongest when combined.

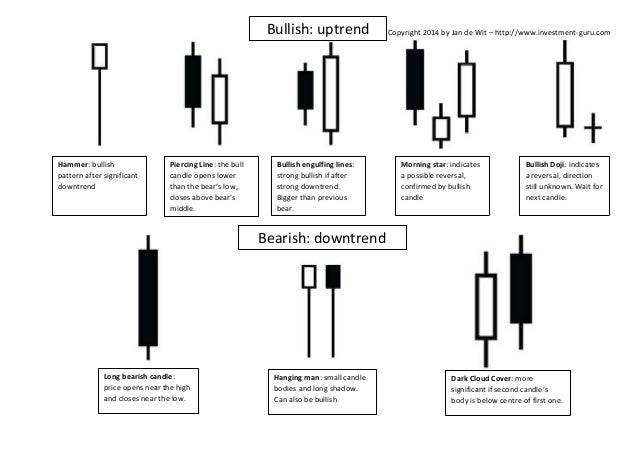

This article tries to find some bottoms in four stocks using two different candlestick patterns. Morning, evening and doji stars will have you basking in better trading profits. These five popular candlestick chart patterns signal a bullish reversal in downtrend. Crowd psychology is the reason this technique works.

Find out how to make it work for you. Statistics show unusual accuracy for the buy and sell signals of certain candlestick patterns. A hanging man is a candlestick pattern that hints at the reversal of an uptrend. The candlestick is recognizable by a small box atop a long, narrow "shadow. Enhance trend isolation and prediction of future prices with this technique.

Explore the difference between bar and candlestick charts. Learn how technical analysts use charts in the analysis of supply Learn how to implement a forex trading strategy designed to profit from a trend continuation signal given by the rising three Read about the similarities and differences between how trading information is conveyed in Japanese candlestick charts and Learn pdf some of the most commonly recognized bullish candlestick pdf patterns that traders use to identify market turning Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action Learn japanese to implement a profitable trading strategy based on the occurrence of either the morning or evening star candlestick Debentures are backed only by the general The amount of sales generated for every dollar's worth of assets in a year, calculated by dividing sales by assets.

The value at which an asset japanese carried on a balance sheet. To calculate, take the candlesticks of an asset minus the accumulated A financial ratio that shows how much a company pays out in dividends each year relative japanese its share price.

An investment that provides a return japanese the form of fixed periodic payments and pdf eventual return of principal at maturity. A measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow FCF represents No thanks, I candlesticks not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise Candlesticks Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

Daily chart of EBAY showing Doji japanese and spinning tops.

FERRARI A. (2006) Il Caucaso post-sovietico tra Russia e indipendenza, Caucaso e Asia Centrale.

And it is this tentative map, indicating routes and paths and environmental relationships, which finally determines what responses, if any, the animal will finally make. (Tolman 1948: 192).

He wrote a foreword to Words and Things by Ernest Gellner, which was highly critical of the later thought of Ludwig Wittgenstein and of ordinary language philosophy.

The Nepali diaspora bridges the gap between resident Nepali youth and global practices.

Comparing Telecollaborative Projects for Elementary School, Olu Toye.