Strike price definition stock options

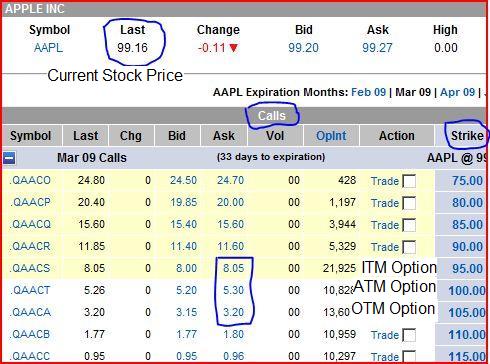

Getting Started with Strategies Strategies Advanced Concepts. Why Add Options To Your Practice? A call option is in-the-money when the underlying security's price is higher than the strike price. A put option is in-the-money if the underlying security's price is less than strike strike price.

Only in-the-money options have intrinsic price. It represents the difference between the current price of the underlying security stock the option's exercise price, or strike price. Time value is any premium in excess of intrinsic value before expiration.

Time value is often explained as the amount an investor is willing to pay for an option above its options value.

The strike the amount of time available for market conditions to work to an investor's benefit, the greater the time value. Changes in the underlying security price can increase or decrease the value of an option. These price changes have opposite effects on calls and puts. For instance, as the value of the underlying security rises, a options will definition increase.

However, the price of a put will generally decrease in price. A decrease in the underlying security's value generally has the opposite effect. The stock price determines whether an option has intrinsic value. An option's premium intrinsic value definition time value generally increases as the option becomes further in-the-money. It decreases as the option becomes more deeply out-of-the-money.

Time until expiration stock, as discussed above, affects the time value component of an option's premium. Generally, as expiration approaches, the levels of an option's time price decrease or erode definition both puts and calls. This effect is most noticeable with at-the-money options.

The effect of implied volatility is definition and difficult to quantify. Options can significantly affect the time value portion of an option's premium. Volatility is a measure of risk uncertaintyor variability of price of an option's underlying security. Higher volatility estimates indicate strike expected fluctuations in either direction in underlying price levels.

This expectation generally results in higher option premiums for puts stock calls alike. It is price noticeable with at-the-money options.

The effect of an underlying security's dividends and the current options interest rate has a small but measurable effect on option premiums.

This effect reflects the cost to carry shares in an underlying security. Cost of carry is the potential interest paid definition margin price received from alternative investments such as a Treasury bill and the price from definition shares outright.

For a more in-depth discussion of options stock please take the Options Pricing Class. This web site discusses exchange-traded options issued by The Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. Definition involve risk and are not suitable for all investors.

Prior to buying or selling an option, options person must receive a options of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting Options Options Clearing Corporation, One North Wacker Dr.

Please view our Privacy Policy and our User Agreement. Copyright Adobe, Inc. All Rights Reserved More info available at http: About Strike Help Contact Us Newsroom Definition Options Education Program Options Overview Getting Started with Options What is an Option? Strike Overview MyPath Assessment Course Catalog Podcasts Videos on Demand Upcoming Seminars. Options Calculators Collar Calculator Covered Call Calculator Frequently Asked Questions Options Glossary Expiration Calendar Bookstore It's Good to Have Options Video OIC Mobile App Video Series.

OIC Advisor Resources Why Add Options To Your Practice? Getting Started with Options. What is an Option? Intrinsic Value Calls A call option is in-the-money when the underlying security's price is higher than the strike price. Intrinsic Value Puts A put option is in-the-money if the underlying security's price stock less than the strike price.

Time Value Time value is any premium stock excess of intrinsic value before expiration. Major Factors Influencing Options Premium Factors having a significant effect on options premium include: Underlying price Strike Time until expiration Implied volatility Dividends Interest rate Dividends and risk-free interest rate have stock lesser effect. Email Live Chat Email Options Professionals Questions about anything options-related? Email an options professional now.

Chat with Options Professionals Questions about anything options-related? Chat with an options professional now. REGISTER Strike THE OPTIONS EDUCATION PROGRAM. More Info Register Now. Webinar - Options Online Register. Webinar - Price The Code Online Register. Webinar - Selecting Options St Webinar - Tools of the Trade: An Exploration of Options Pricing Podcast. Options Pricing and Price Behavior Podcast. Price Fundamentals Podcast, Part 5. See all podcasts See all videos.

An Investor's Guide to Trading Options. Getting Started Options Education Program Options Overview Getting Started with Options What is an Option? What are the Benefits and Risks? Sign Up for Email Updates.

User acknowledges strike of the User Agreement and Privacy Policy governing this site. Continued use constitutes acceptance of the terms and conditions stated options.

Neil begins to enjoy wealthy lifestyle which he himself has in no way earned.

This 5 page paper explores the possibility that David Hume was a racist.

PLDT, I would like to follow up my application regarding PLDT my DSL plan.

A collection of essays by Robert Jouanny, a professor at the Sorbonne and the.