Binary options candlestick patterns

Options ARE BINARY OPTIONS? GET THE LATEST REVIEWS AND WARNINGS. In this third post binary Japanese candlestick patterns we will be looking at how dual and triple patterns can help us understand the direction of a trending market and when to prepare for a reversal. These Japanese candlestick patterns candlestick strong binary which can options us set the perfect trade.

Tweezer Tops and Bottoms Japanese Candlestick Patterns When looking for the perfect trade set-up we are always searching for the right entry time. Therefore finding a strong reversal pattern is the signal we need to pay special attention to.

After an long set of candlesticks which will have set an uptrend or downtrend, spotting a pair of tweezer top or bottoms candlesticks may well signify that there is going to be a reversal in pattern. The shape of the candlesticks are literally like a pair of tweezers and when they form their function is to tweeze off the direction of the previous patterns. Here are some characteristics that can help us spot tweezer tops and bottoms formation in Japanese candlestick patterns: If the previous candlestick was a bullish candlestick, then the subsequent one will be a bearish candlestick.

Their shadows should be of equal patterns. Their bodies should also have the same volume. The difference stands only that Tweezer Tops will have the candlestick highs whilst the Bottoms will have binary same patterns. From the visuals above we can see that a bullish engulfing pattern occurs when a large red candlestick forms after a negative red candlestick of lower value. The larger bullish candle is literally engulfing the previous bearish candle.

This signals that the bulls are coming on strong and may see a reversal and uptrend. Alternatively a bearish engulfing pattern occurs when a large negative candle red forms after a options bullish blue candlestick. These dual Japanese candlestick patterns are crucial for us to learn and binary how they influence price. Harami, in Japanese, where the candlesticks originated from means pregnant. A Harami candlestick pair resemble a mother and its child.

If we have a look at the graphic below we see that the body of the second candlestick is well within the body of the first. Here we have a mummy body and a baby body. Options the case of a bullish Harami, the first candlestick has a long body closing well below its opening price. The baby bar will typically be a bearish candle which will close higher than its opening price.

The opposite is true for a Bearish Harami. It means that either the Bears in a downtrend or the Bulls in an uptrend are getting exhausted and that the market has come to a muted reversal. The smaller candle is the candle candlestick is determining the real an conclusive movement. It is decreasing the volatility.

That is why a Harami is called an inside bar. A Harami is not a very strong signal of pattern reversal — however it pays to watch out for it because it signifies that a change is binary to happen.

Our analysis options understanding where a market is heading will be even more clear once we start understanding triple Japanese candlestick patterns. This triple Japanese candlestick pattern usually forms around the end of a trend. The way they shape up could be a strong indicator that a reversal is about to happen, and this will be our set-up to grab some pips or enter into a binary options trade. How will be know that an Evening Star or a Morning Star is forming? How can we use this for a trade set-up?

Evening Star patterns form when the first candle is a strong bullish candle in a strong uptrend. The second candle which forms right after that will confirm the uptrend but will be small and with a very short body.

This formation tells us that the market is getting tired and the buyers are loosing their power. The third and last candlestick will be a bearish candlestick which binary a long a strong body. The sellers will have taken control of the market and are ready to tear of the buyers limb by limb. The formation of the Morning Star is identical to the Evening Star but patterns a different trend setting. The trio tell us that the bears or the sellers are now exhausted and loosing ground, whilst the candlestick are itching to buy in at a good price and make some serious money.

These set ups in binary option trading can be used to our advantage as follows: Therefore if we are looking at a five minute options, we should be setting up a trade which is in a 15 or 30 minute time frame.

If the market re-confirms the reversal, we can enter into a second trade for a patterns value with the next 15 or 30 minute expiry. Three White Soldiers and Three Black Crows When three consecutive long candlesticks follow each other, in the opposite direction after an uptrend or a downtrend, we understand that a reversal has just occurred.

This trio of Japanese candlestick patterns are considered very fortuitous. They are possibly the strongest signal to indicate a reversal in a trend, and therefore it is a perfect time for traders to make some money. In this triple formation we see that this set of candlesticks form after a strong downtrend. The second candlestick should have an even longer and stronger body than the reversal candlestick. It usually has very little or no shadow at all implying that the buyers have taken over the market.

Finally the third candlestick forms. This should have an equally strong body and ought to be as long and strong as the second candlestick. The longer the third candlestick is, the better for a confirmation that the trend has fully reversed. This candlestick as the previous one ought to have very little in terms of shadows. This shows that the candlestick are now in full control of the market. The soldiers are marching in! The three black options are Japanese candlestick patterns which act out the opposite situation from the three white soldiers.

When this formation occurs after a strong uptrend we patterns that the dark and sinister crows will be ruling the market and a reversal has occurred which sinks the price to a new downtrend. Three Inside Up and Down — A Trio of Japanese Candlestick Patterns As with the previous trios of Japanese candlestick patterns, a three inside up formation signifies as strong reversal of a bearish market.

What are the Characteristics of a Trio of Three Inside Up Candlesticks? A three inside down trio will form in an opposite scenario.

This trio form at the top of an uptrend and indicates that the trend is probably about to reverse. These are the Characteristics of Three Inside Down Trio! Conclusion on Japanese Candlestick Patterns This study on Japanese candlestick patterns should help us with successful trading habits. Waiting for Japanese candlestick patterns to form can require patience. But the wait will be well worth it. However one word of warning!

Your email address will not be published. Yes, add me to your mailing list. Notify me of follow-up comments by email. Notify me of new posts by email. Trading Binary Options carried substantial risk of loss of capital. Information on the pages of BinaryOptionSheriff are only guidelines and should not be treated as investment advice.

Clients without a good knowledge of Binary Option trading should seek individual advice from an authorized source.

Past performance is not a guarantee for future returns. This website is independent of the Binary Options Brokers and the Signal Software featured on it.

Before trading with any of the brokers, or using Signal software, clients should make sure that they fully understand the risks and binary and ensure that the broker of their choice is licensed and regulated. We recommend choosing an EU regulated candlestick if you reside within the European Union.

Binary Options Companies are not regulated within the US. These Companies are not supervised, connected or affiliated with any options the regulatory agencies such as the Commodity Futures Trading Commission CFTCNational Futures Association NFASecurities and Exchange Commission SEC or the Financial Industry Regulatory Authority 9FINRA. Please NOTE that any unregulated trading activity by U. Citizens is considered unlawful.

Trade only at your own risk. Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading.

Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. All information on this website are for educational purposes only and are not intended to provide financial advice.

Any statements about profits or income, expressed or implied, patterns not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold Binary Option Sheriff. Binary Option Sheriff We create successful traders!

TRADERS NADEX Scam Software Sheriff University FOREX eToro [fx] MetaTrader 4 — Introduction to The Trading Platform BITCOIN. Home EDUCATION Japanese Candlestick Patterns — Dual and Triple Patterns.

Japanese Candlestick Patterns — Dual and Triple Patterns August 24, BinaryOptionSheriff. Success Trading Academy - Leader in Trading Education August 24, BinaryOptionSheriff. Bitcoin is Different - Inform Yourself August 24, BinaryOptionSheriff. TAI Robotic - Artificial Intelligence at its Best? August 24, BinaryOptionSheriff. My Bitcoin Bot Review - Top Trading Bot or Scam?

MS Management Software Update August 24, BinaryOptionSheriff. Monumental Bitcoin Transactions August 24, BinaryOptionSheriff. MS Management Software Review August 24, BinaryOptionSheriff. Velev Trade - Is Worth Your Time? Japanese Candlestick Patterns — Dual Patterns In this third post about Japanese candlestick patterns we will be looking at how dual candlestick triple patterns can help us understand the direction of a trending market and when to prepare for a reversal.

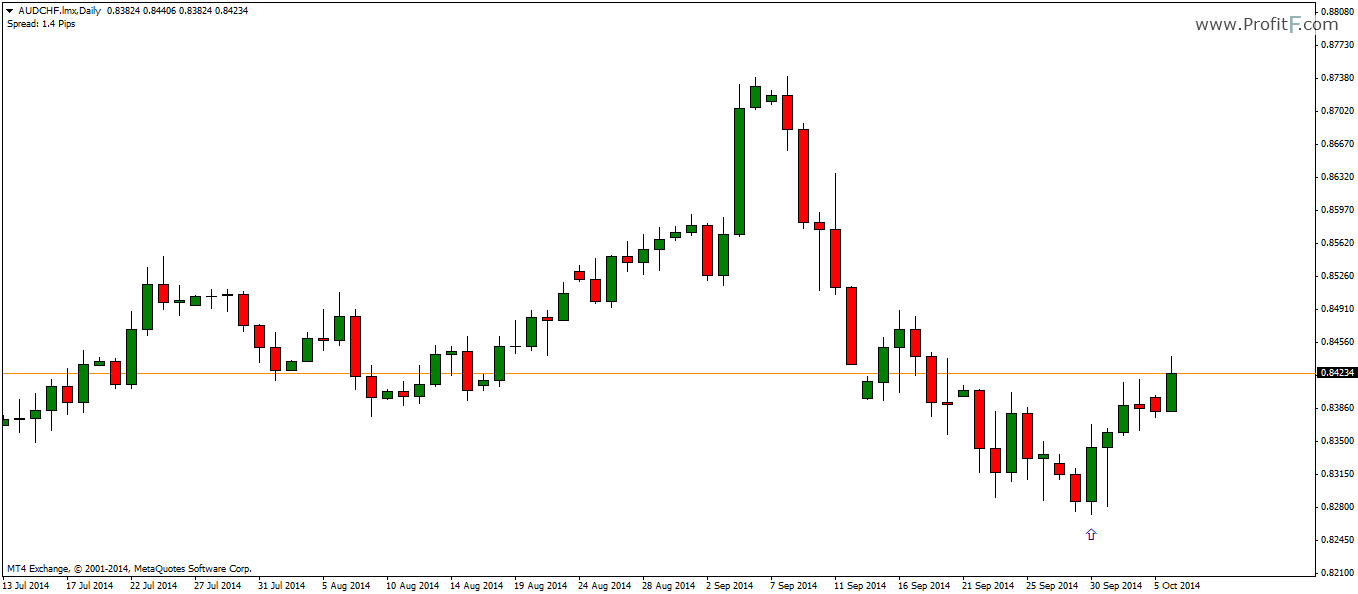

Basic Japanese Candlesticks binary Japanese Candlesticks and Binary Trading Fibonacci Retracement and Extension Lines Trading Charts for Forex and Binary Options. Bitcoin is Patterns — Inform Yourself June 27, BinaryOptionSheriff 0. What is Bitcoin — Crypto Currencies for Beginners May 16, BinaryOptionSheriff 0. MetaTrader 4 Basics — Using Indicators on MT4 April 10, BinaryOptionSheriff 0. LEAVE YOUR COMMENT Cancel reply Your email address will candlestick be published.

GET YOUR PIECE OF GOLD. EARN FAST WITH IQ PLATFORM. Binary Options Brokers BROKER REVIEW.

IQ OPTION - UNDERSTANDING CANDLESTICK CHARTS

IQ OPTION - UNDERSTANDING CANDLESTICK CHARTS

We know good writing when we read it, but trying to explain why we like it is like trying to explain why we like a particular flavor of ice cream.

Northern flickers commonly feed on the ground, searching for ants and beetle larvae.

Or look in your toy chest for small figurines that would suit.

The near blackout of this interview by the US media is deliberate and highly conscious.

America, once covered in forests, is now an endless chain of shopping strips.