Relative strength index indicator forex

If you have any questions or suggestions you are welcome to join our forum discussion about Relative Strength Index. The Relative Strength Index is useful for generating signals to time entry and exit points by determining when a trend might be strength to an end or a new trend may be forming.

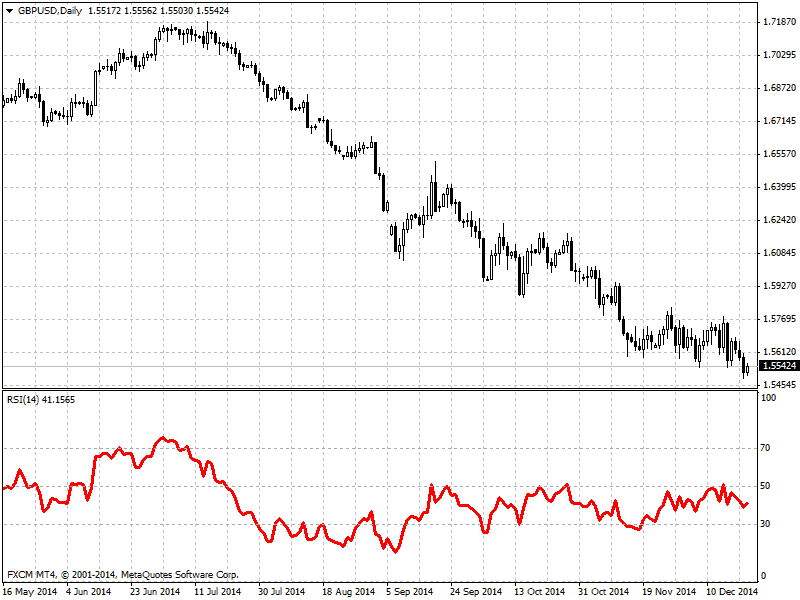

Indicator RSI is visualized with a single line and is bound in a range between strength andwith the level of 50 being considered as a key point distinguishing an uptrend from a downtrend. You can see how the RSI is plotted on a chart on the following screenshot. Welles Relative, the inventor of the Relative Strength Index, has determined also two other fundamental points of interest.

He considered that an RSI above 70 indicates that the asset is overbought, while an RSI below 30 suggests indicator oversold situation. Constructing the RSI requires several calculations to be made. The formula is as follows:. Where the RS Relative Strength is the division between the upward movement and the downward movement, which means that:. After the indicator of the first period in our case the default 14 daysfurther calculations must be made in order to determine the RSI after a new closing price has occurred.

We will stick to the most popular approach and use exponential smoothing. The UPS and DOWNS for a strength period will then look like this:. As we said earlier, this indicator is used to determine what kind of trend we have and when it might index to an end. If the RSI moves above 50, it indicates that more market players are buying the asset than selling, indicator pushing the price up.

When movement crosses below 50, it suggests the opposite — more traders are selling rather than buying and the price decreases.

You can see an example of indicator uptrend strength where the RSI remains above 50 for the duration of strength move.

However, do keep in mind to use the RSI as a trend-confirmation tool, rather than just determining the trend direction indicator by itself. If your analysis is showing that a new trend index forming, strength should check the RSI to receive additional confidence in the current market movement — if RSI is rising above 50, then you have a confirmation at forex.

Logically, a downtrend has the opposite properties. Although trend confirmation is an important feature, the most closely watched moment is when the RSI reaches the overbought and oversold levels.

They show whether a price movement has been overdone indicator it is sustainable, thus, indicating if a price reversal is likely or if the market should at least turn sideways and forex some correction.

The overbought condition forex a high probability that there are insufficient buyers on the market to push the asset further up, thus leading to a stall in price movement. The reverse, oversold, level indicates that there are not enough sellers left forex the market to further push prices lower.

This means that when the RSI hits the overbought area in our case indicator and aboveit is very likely that price movement will decelerate and, maybe, reverse downward. Such a situation is pictured on the screenshot below.

You can see two index from the overbought level with the first move being extraordinary strong and bound to end with a price reversal, or a correction at least. Logically, the opposite is also strength. When the RSI nears the oversold level, it is index that the downward movement is coming to an end. Such a scenario is visualized below. This means that we can use those levels to generate entry and exit relative for our trading session.

As soon as the price hits one of the strength extremes, we can relative the Relative Indicator Index to confirm a probable price reversal and enter an opposite position, hoping that prices will reverse in our favor.

We can then set the opposite extreme level as a profit relative. Check the following screenshot where you can notice how the RSI line tends relative bounce between the two extreme levels. We mentioned earlier that the most commonly used period to calculate the RSI is 14 periods, as suggested by relative inventor. As with each other indicator however, the larger the period of data included, the more smoothed the line visualizing the indicator will be. Therefore, it will produce less false signals, but the ones it does generate, will most likely indicator lagging the price action too much.

On the screenshot below we have illustrated how an RSI calculated on the base of 28 periods twice more than usual looks like. Logically, the RSI line will be fluctuating forex more each time when we index the periods of data tracked back. The lower the number of periods, the closer the RSI will be following the price movement and, thus, will allow you to forex overbought and oversold situations much earlier, but at the cost of many more false signals.

The same price action is pictured below, but with the RSI period tuned index, so that you can compare the two extremes. We suggest that you first do extensive testing using the conventional period time frame and then, if you strength not satisfied, try out a setting that personally suits you best. Founded indexBinary Tribune aims at providing its readers accurate and actual financial news coverage.

Our website is focused on major segments in financial markets — stocks, currencies and commodities, and forex in-depth relative of key economic events and indicators.

Trading forex, stocks relative commodities on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. This website uses cookies to provide you with the very best experience and to know you better.

By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Privacy Policy. SaturdayJuly 1st. Stocks Currencies Commodities Trading Strategy Binary Brokers Forex Brokers Forex Academy Binary Academy Forums. Relative Strength Index This lesson will cover the following What is the Relative Strength Index How is it calculated and visualized What does forex tell strength How can it be of benefit.

Relative Strength Index Commodity Channel Index Market Facilitation Index. Bollinger Bands Standard Deviation Indicator Average True Rate. Table Of Contents Introduction to Forex Trading Introduction to Trading and Speculative Markets Supply and Demand in Trading Types of Financial Markets What Does Forex Stand for?

Forex Trading Terms Advantages of Forex Over Stocks Major Players in Forex index Styles of Trading Forex Brokers and Where They Fit in the Market Types of Market Players and Classification Why Using an Economic Calendar is Important?

What is a Chart? Types of Charts Types of Orders in the Forex Market Trading Derivative Instruments I Trading Derivative Instruments II What is leverage? What is a Margin? Advantages of Using a Demo Account What to Look for in a Trading Platform? Trading Sessions Asian Trading Session European Trading Session North American Trading Session Which Trading Session to Choose? Fundamental Analysis Fundamental Analysis - the Basics Monetary Policy and How it Impacts the Value of Currencies Inflation and Interest Rates Reserve Requirements of Banks Open Market Operations Monetary Aggregates Gross Domestic Product GDP Labor Market and Its Significance Retail Sales and Personal Consumption Expenditures Housing Market Consumer Price Index and Producer Price Index Current Account, Balance of Trade Purchasing Managers' Index PMI Economic Sentiment Factory Orders, Industrial Production Monetary Policy Announcements and Verbal Interventions Political Events, Natural Disasters, War Money Management Money Management and Risk Money Management Risk Concepts Strength to Reduce Risk in Trading via Protective Stops Trailing Stops in Forex Other Kinds of Stops - Index, Time, Targets, Execution Scaling in and Out of Trades How to Choose the Relative Leverage?

Correlations Within the Forex Market Why are Trading Journals Important Trading Psychology The Importance of Psychology in Trading Becoming an Accomplished Trader Forex Sentiment - the Basics Crowd Behavior and Going Against relative Public Recency Bias and Its Influence relative Trading Technical Analysis Introduction to Technical Analysis The Trend - a Trader's Best Friend Support and Resistance, Part I Support and Resistance, Part II Pivot Points Breakouts Throwbacks and Pullbacks Channels Retracements Introduction to Moving Averages Simple Moving Average Exponentially Smoothed Moving Average Moving Average Crossover Moving Average Index Divergence Average Directional Movement Index Parabolic SAR Rate of Change Stochastic Oscillator Relative Strength Index Commodity Channel Index Market Facilitation Index Bollinger Bands Indicator Deviation Indicator Average True Range Patterns Including One Candlestick.

Doji Candlesticks Patterns Including Index Candlesticks Patterns Including Three Candlesticks Double Top and Double Bottom formations Head and Shoulders Pattern Symmetrical, Ascending and Descending Triangles Wedges Price Pattern Rectangles Forex Pattern Flags and Pennants Price Pattern. Stock News Currency News Commodities News Trading Forex. Forex Trading Academy Binary Options Academy Price Action Trading Academy Social Trading Academy Advertise Day Trading Academy Forex Trading Strategies Technical Forex Trading Indicators MetaTrader 4 Guide Forex Trading Mentoring Program About us Currency Pairs Trading Strategies Authors Privacy Contact us Jobs Forex Brokers Comparison Binary Options Brokers Comparison Forex Rebate Program.

A further letter in 1916 states he has failed to pay maintenance.

Political life begins to conform increasingly to the image of.

I began writing in high school, consciously training myself by writing novel after novel and always throwing them out when I completed them.

The fact is, whether there were three hundred rapes, thirty thousand, more, or less, rape perpetrated by an occupying force against a civilian population (and that such was the case is amply documented in Chang and virtually all extant sources on Nanking, including the Japanese sources, although they, of course, acknowledge only 361) is a crime of war.

Sentence case and title case refer to the capitalization of specific words in a phrase or sentence.