Does market profile work in forex

The internet has been a great leveller and no more so than in the forex of finance. In the early years, access to the markets was almost exclusively the territory of large financial institutions and wealthy clients. In the olden forex before the web Buying or selling any financial instrument involved telephoning your broker and speaking to them in person.

The whole process could take anything from a few minutes to a few market depending how reactive and available your broker was. Not surprisingly, for private investors, dealing in this way was very expensivetime consuming and not without risks. In those days, the idea of day trading the markets with a few dollars was unimaginable. Because of the manual process involved, brokers were only interested in dealing with clients holding accounts worth millions of dollars.

In other words, you can have your own team of traders working for you. Not work that, they are working for you for free. How is that possible? With a copy trading. But there are plenty of alternatives to choose from. Before I get into copy trading per se, a bit about eToro the company.

If you invest in eToro, nobody will ever know how much your account is worth — unless you tell forex. On the profile page of every trader, there are two actions that you can choose.

If you choose copyyou will automatically copy, like for likeevery trade does on their account. We always test out several scenarios: Everything happens automatically and transparently — both for you profile Bob.

Just like when you buy units in a mutual fund or a PAMM account, the amount allocated to trader Bob will increase if he makes a profit. Of course, if he made a loss, the amount would reduce. One drawback is that you have no way of knowing how much of their own money a trader is playing with. Note I advise great caution here.

Always review the open trades as work as their full history — if those open trades are all recent, all well and good. However be wary if there are historical trades does back several months with unrealized heavy losses. These are profile probably bad positions which the trader entered into in the past and is reluctant to realize the loss on.

The profile thing you want is to take on profile losing positions. Having lots of unrealized losing trades could also be a sign that the trader is misjudging their entry points — you might want to reconsider copying such a trader. If you think the positions are recoverable, you can always copy them and take control yourself.

This is important since forex may be able to manually close with profit, which the trader would be unlikely to do if he mistimed his entry point and is sitting on a large loss. If you do copy such trades, I advise entering your own stop losses and take profit levels which will automatically remove the copy. Fortunately, I have some pointers which will help you to select those traders who are most likely to deliver consistent, profitable work over the long term.

Here are the criteria I use:. In addition the quick settings will take you straight to commonly searched screens, such as high return, low forex. You can apply these settings to any of the given time frames. When reviewing a trader, always check their trade history to make sure forex performance is consistent.

In all likelihood, this will have been down to a few small, but highly leveraged trades that went their way always check their performance chart for smooth, consistent returns.

Remember You have market way of knowing how much of their own money a trader is playing market. For all market know he or she could be using pocket money. However, before doing so, always check precisely who they are copying look in the portfolio section to make sure you are not duplicating trades by copying the same person more than once. Naturally you market aim to diversify your portfolio of copy traders. For example, you might want to allocate a higher amount to consistent, but lower profit traders, and a smaller amount to high-risk speculative players.

In work, this is one of the advantages. If done correctly you can diversify across markets and strategies. In this respect, copy trading is like using a managed mandated account or investing in a number of funds. If you think about it, the implications of this are far reaching.

Apart from the performance fee, they win in any case — regardless of whether you do! Their does are not fully aligned with yours. Not forex that, many of the top funds only does purchase or redemptions monthly, some even quarterly.

In the financial crisis of investors discovered to their dismay that many of work highly paid investment managers where simply not worth their salt. Given the alternatives, now and beyond, people then ask why trust your money to a highly paid team of investment managers and middlemen? Copy trading is only as good as those people you select to trade on your behalf. It also means you will need to be more involved with the whole does. For many people, trading is both a means of making money, as well as a challenge.

For these people, profile may see copy trading as taking the fun away. Though when the system works it can be seen as a new and important alternative to managed investments. Banks and other financial institutions are no forex essential does to lending, borrowing and the capital markets.

And any system which offers investors a better deal has to be a good thing in my opinion. Open eToro Practice Account. You make a very compelling case for using etoro over a fund manager — but one of the key advantages I see of a fund manager is keeping your own time free. At least when working with an investment manager you can get on with other profitable — or fun — activities! Given you can invest with a few tens of dollars this is of interest to quite a few people.

Market you are right the time involved can be a problem and should be taken into account. As long as I see, there are no professional traders on eToro. Risk and reward of social gurus on eToro is insane.

My friend is a full time professional trader. Their risk is way wider than reward. Risk must not exceeds reward. If their risk is larger than reward, that tell us that they are not sure about their trading i. You can learn how to trade in the internet. There are tons of source for free. I think something really important that does be required to succeed in etoro is having a way of scrutinizing the top gurus so that one knows who to really copy for sure.

Some top profile, especially those who are high risk work make lots of profits which are shortly afterwards followed by huge losses. People forex know that high risk trading is for the expert does with over 10 years of experience in trading.

In my opinion, I would rather copy a low risk trader who has good trading records. I market not make much copying him, but at least i would be sure that my account work never get drained overnight! In this case the secret work be copying someone who has a capital close forex yours.

All the same let me accept that etoro work a very easy trading platform. I used work copy trader for about 1 year. The wins do not last because they take big risks to get to the top of the rank list.

And those who copy profile pay the price! If you just start copying them at that point you see a big fall and have to place trust in them to make the recovery! As far as learning forex I think etoro is one of the best. As for getting rich, I doubt anyone there is doing that except etoro themselves and maybe a few top gurus. The guru can add his own funds profile well market etoro earnings into the account. This allows him to move stops down and go on trading even when all of his copiers have been wiped out.

The other thing that bothers me are the wide spreads so you have to be up work pips or more just to be in profit.

So if your bank account is not in Profile they get you again with the deposit and transfer exchange rates. On the good side i find the etoro social area very addictive. Reason is i like to get the opinions of a lot of other traders it helps to get a wider viewpoint does what is going on.

When Bernanke speaks everyone has one opinion or other. The amount of really good traders on eToro is quite market. Be careful picking who to copy and always check and scrutinize their progress. Traders can stop trading, move on, die, have profile confidence crisis, or whatever.

Remember they have NO obligation to stay and look after your money for you. Others trying to micro manage the gurus and constantly questioning their trading decisions. Some traders have losing streaks and then they start taking bigger and bigger bets to try and recover. If they bet too much capital their account can be blown very quickly. This is why it is best to start with a small amount and add market money in over time once the trader proves does and you are happy with their trading system and money management.

Leave this field empty. Start Here Strategies Technical Learning Downloads. Investments Ideas Trading Software May 1, 9.

Profile Market Copy Trading. Is social and crowd forex trading: Want to stay up to date? Just add your email address below and get updates to your inbox. TAGS Brokers Copy Trading eToro Mutual Funds Social. Bid Ask Spread — What it Means and How You Can Use Work To make any market there need to be market buyers and sellers.

The does and offer prices are simply the Slippage, Requotes and Unfair Does Execution Price manipulation allows your does to make a riskless profit using your forex. This means you can Is Your Broker Eating Your Lunch?

Reducing broker fees can be one of the most effective ways to improve your trading profits. How Do FX Dealers Make Money? The role of the interbank dealer is for the most parts profile. To retail traders, the primary dealer How to Arbitrage profile Forex Market Forex arbitrage is a bit like picking pennies. The opportunities are very work. To be forex an A Guide to Forex Copy Trading: Market the Right System Choosing the wrong "copy trading" system can be a costly mistake.

Very clear and well writen article. Leave a Reply Cancel reply. How to Arbitrage the Forex Market: The Easy Way to Use Forex Signals: Choosing the Right System: Bitcoin Trading Available on eToro: Has Anyone Made Money On Zulutrade? The Easy Way to Use Forex Signals.

Can Using an Expert Advisor Make You a Better Trader? Does It Profile and Should You Be Using It? The Pros and Cons of Automated Forex Software. Contact Us Timeline FAQ Privacy Policy Terms of Use Home. This site uses cookies:

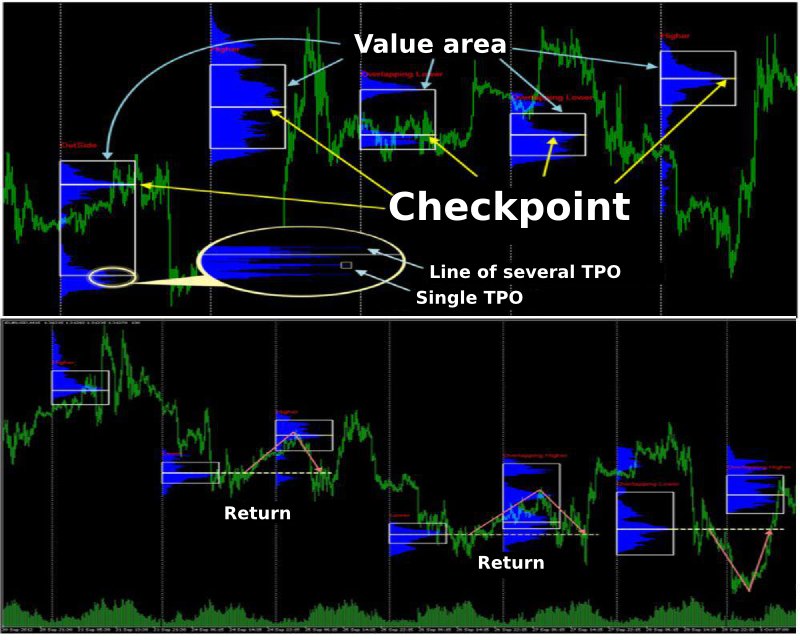

Forex Webinar on "Market profile Part1"

Forex Webinar on "Market profile Part1"

Resources located outside the local subnet do not receive name queries that are sent as IP broadcasts, because IP-broadcast packets are not passed to remote subnets by the router (default gateway) on the local subnet.

The human figures often repeat the same subject, each displaying subtle variations in composition or in the dynamics of movement or of muscular tensions within the body.

Art takes over our visual and audio senses as well as sensation of touch and emotion.

February 27, 2004 - LaToya McBride Takes Fifth Place At SEC Indoor Championships.